Washington State New Investment Income Voluntary Disclosure Program: What You Need to Know

Great news for businesses in Washington State! The Department of Revenue (DOR) is rolling out a temporary, expanded Voluntary Disclosure Program specifically designed to help businesses come clean on previously unreported investment income subject to Business & Occupation (B and O) tax. Starting July 1, 2025, qualifying businesses can report this revenue without facing the usual penalties or interest.

This is a significant opportunity to get your tax affairs in order, so lets break down the key aspects of this new program.

What is the Program All About?

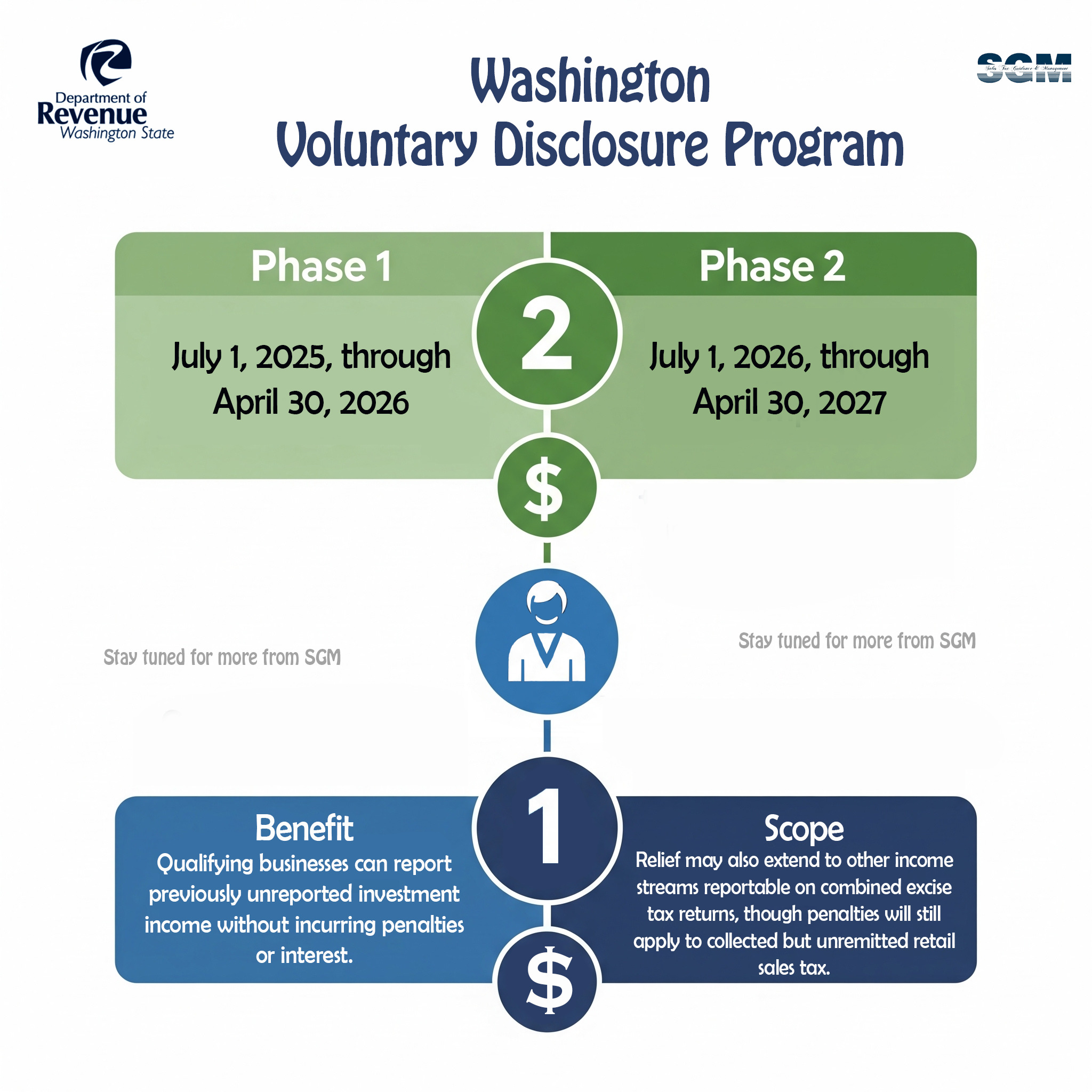

This program offers a unique chance for businesses to voluntarily disclose unreported investment income that is subject to B and O tax. The best part? For qualifying disclosures, the DOR will waive penalties and interest on that income.

While the primary focus is investment income, you might also get relief for other income streams reportable on combined excise tax returns. However, it is crucial to remember that if you have collected retail sales tax but have not remitted it, penalties will still apply to those amounts.

A Two-Phase Rollout

To ensure a smooth process, the program will be administered in two distinct 10-month phases over the next two fiscal years:

• Phase 1: July 1, 2025, through April 30, 2026

• Phase 2: July 1, 2026, through April 30, 2027

Who Qualifies?

Generally, any registered or unregistered business with unreported investment income subject to B and O tax can qualify. There is a key exception: you wont qualify if you have already been notified of an audit or agency enforcement action as of July 1, 2025. Interestingly, affiliates of entities currently under audit might still be eligible for this beneficial treatment.

Who Doesnt Qualify?

Businesses primarily engaged in banking, lending, and security (as defined in RCW 82.04.4281) typically do not qualify for this program. The Department of Revenue may also update its website with additional businesses that are excluded. If you are unsure about your eligibility, the Department advises submitting a letter ruling request for clarity.

Significant Benefits of Voluntary Disclosure

Participating in this temporary expansion can offer your business substantial advantages:

• Limited "Look Back" Period: Your tax liability will only be assessed for the prior four years plus the current year, providing a clear boundary for past obligations.

• Waiver of Penalties: You could see a waiver of up to 39% in potential penalties, including:

o A 5% assessment penalty for substantially underpaid tax.

o A 5% unregistered penalty.

o A 29% late payment of a return penalty.

• Simplified Assessment: The Department can summarize your unreported tax liability into a single, straightforward tax assessment.

• Interest Waiver: All interest on the unreported investment income will be waived.

Important Note: For any collected but unremitted retail sales or use tax, there is an unlimited "look back" period, and the 29% late payment penalty will still apply to those specific amounts.

Stay tuned for more from SGM - https://dor.wa.gov/open-business/apply-business-license/voluntary-disclosure-program/investment-income-voluntary-disclosure-program

Suggested keywords:

Washington State Investment Income Voluntary Disclosure Program, WA DOR VDP, Washington B and O tax relief, unreported investment income Washington, WA tax penalties waiver, Washington State tax compliance, voluntary disclosure program WA, B and O tax investment income, Washington tax amnesty, tax relief for businesses WA, voluntary disclosure Washington State Department of Revenue, WA tax audit relief, Washington State tax law update, B and O tax compliance Washington, investment income tax WA, voluntary disclosure benefits Washington, limited look back period WA tax, penalties waived Washington tax, interest waived WA tax, Washington State business tax, tax reporting Washington, tax liability WA, SGM website tax blog